Some people believe day trading top penny stocks is this super fun and ultra-exciting endeavor.

Don’t get me wrong, it can be, but overall there are a ton of misconceptions of what traders do and what the general public assumes they do. With that said, let’s take a look at some of these misconceptions.

Trading Is Exciting

Since the financial crisis of 2008-2009, central banks have taken an extremely active role in the markets. Not just in the United States, but across the globe. With that said, volatility in the longer term has declined, substantially. Not only that, but algorithmic trading dominates the volumes we see in the markets today.

What does that mean to active traders who like top penny stocks?

Well, opportunities are scarce. There might be only a couple of good trade setups in an entire day. Sometimes the markets are slow there are no opportunities. With that said, traders spend their time doing less trading and working on other parts of their game. For example, they may spend time researching new ideas and reviewing things they could have done better. You see, traders are not trading to rack up commissions or churn their accounts, they trade to make money. If opportunities are slim, they must be patient.

The Barrier Of Entry With Top Penny Stocks Is Always Low

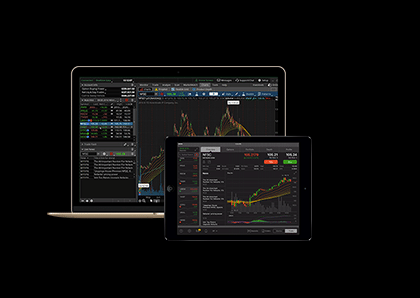

If you want to compete against high frequency trading programs be prepared to spend some money. It’s not uncommon for high-level day traders to spend upwards to $3k-$5k on technology and infrastructure. This may include filters, alerts, news  services, trading platforms, research, routes, chat rooms, and a whole lot more. To think you can compete with a retail brokerage account is simply silly. Professional traders view trading top penny stocks as their business and understand that there is a cost of doing business. If you think they are relying on CNBC and Twitter to get their news you’re sadly mistaken.

services, trading platforms, research, routes, chat rooms, and a whole lot more. To think you can compete with a retail brokerage account is simply silly. Professional traders view trading top penny stocks as their business and understand that there is a cost of doing business. If you think they are relying on CNBC and Twitter to get their news you’re sadly mistaken.

The Hours Are Short

Now, just because the markets run from 9:30 AM to 4 PM doesn’t mean that is when a trader’s day is over. Generally, traders will come in an hour and a half to two hours before the trading day starts. They catch up with with what has happened in the overseas markets as well as read the latest news and bank research. In other words, they are preparing for their day early, not waiting for the markets to open to start the day with top penny stocks. Since high frequency traders are less involved in the pre-market and after-hours, it’s not surprising to see some good opportunities during those periods. When the trading day is over, they will spend a couple more hours reviewing their trades and start analyzing what they could have done better.

Let’s not get it twisted

There are moments when day trading can be extremely thrilling, and the profits made can match those of professional athlete. But there are over 250 trading days in a year. Day trading in general is a grind, and because most of the time nothing happens it becomes more of a mental challenge than anything with top penny stocks. Discipline plays a huge role in one’s success. Another misconception is that traders are wild risk takers, this is simply not true. The best traders are extremely disciplined and analyze trades on a risk to reward basis.