When it comes to trading good stocks to buy there are several schools of thought. Some traders prefer to day trade exclusively. They find comfort in closing out the day in cash, knowing that an overnight event can’t hurt them.

On the other hand, some traders like to hold on to positions for days, weeks, or even months, in hopes of capturing larger moves. Their thinking is that day trading involves too much randomness and that the markets are largely dominated by algorithmic trading.

What’s the best way to trade?

Well, in order to day trade good stocks to buy there are certain requirements that  need to be met. For example, if you execute 4 or more day trades in 5 business days in a margin account, provided the number of day trades are more than 6 percent of the customer’s total trading activity for the same five-day period. You’ll be labeled a pattern day trader and you’ll need to have a trading account size of $25k or better. If you exceed the set amount of trades and your account is below this level, your broker will temporarily freeze your account from trading.

need to be met. For example, if you execute 4 or more day trades in 5 business days in a margin account, provided the number of day trades are more than 6 percent of the customer’s total trading activity for the same five-day period. You’ll be labeled a pattern day trader and you’ll need to have a trading account size of $25k or better. If you exceed the set amount of trades and your account is below this level, your broker will temporarily freeze your account from trading.

With that said, some traders have no choice but to swing trade, since they are starting with a small account.

Day trading

Overall, day trading is extremely difficult and very expensive, relatively. For example, speed plays a pretty big role in day trading. That means you’ll need pay for alerts, filters, news services, charting packages… the list goes on and on. After all, you’re competing against other professionals who understand the cost of doing business.

What’s the benefit of this type of trading good stocks to buy?

Well, you get to leverage your capital on a couple of opportunities per day. Not only that, but let’s say you have a bad day trading, the next day you start fresh. There is  no carry over effect, and psychologically, this sits well with a lot of traders. If an opportunity arises, they don’t have to move things around to take advantage of them.

no carry over effect, and psychologically, this sits well with a lot of traders. If an opportunity arises, they don’t have to move things around to take advantage of them.

On the other hand, it eats up a lot of your day. For the most part, it’s hard to predict when opportunities will arise, or if they ever do. You’re more or less glued to the computer screen all day.

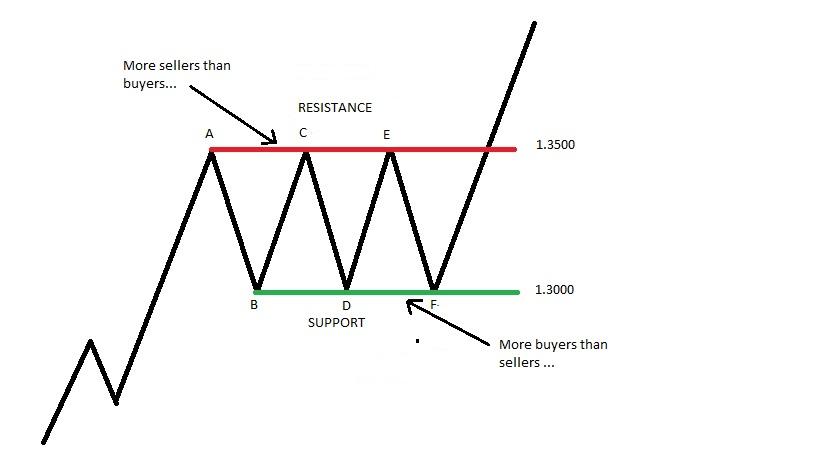

Swing Trading

Swing trading takes a longer term approach. If you have more of a fundamental or macro thesis swing trading is better suited for your style. If you’re confident in a play, but unsure of when it will eventually move in your direction, again, swing trading good stocks to buy makes a lot more sense. Not only that, but your execution doesn’t have to be as precise and you don’t have to stay glued to your computer screen all day.

Downside to swing trading

On the downside, you’re vulnerable to overnight risk. Something crazy could happen to the stock or the overall market that could cause your position to take a severe hit. With that said, you can try to minimize that by hedging.

Some traders will both day trade and swing, there are a number of factors involved when deciding which is the most suitable. One is not better than the other in terms of good stocks to buy.