The investment universe is vast, showing over 7,000 stocks, and many more if participants are willing to look. How do successful traders and investors narrow the universe and identify stocks to watch? Trading strategies vary widely. In addition, so do the stocks that support these strategies. Consequently, it is important to identify stocks that support profitable strategies. This article will discuss stocks that consistently reward traders if those traders are able to execute the strategy. In addition, we will analyze metrics that make these names the best for a stock watch list. Market Leading Stocks To Watch The simplest of

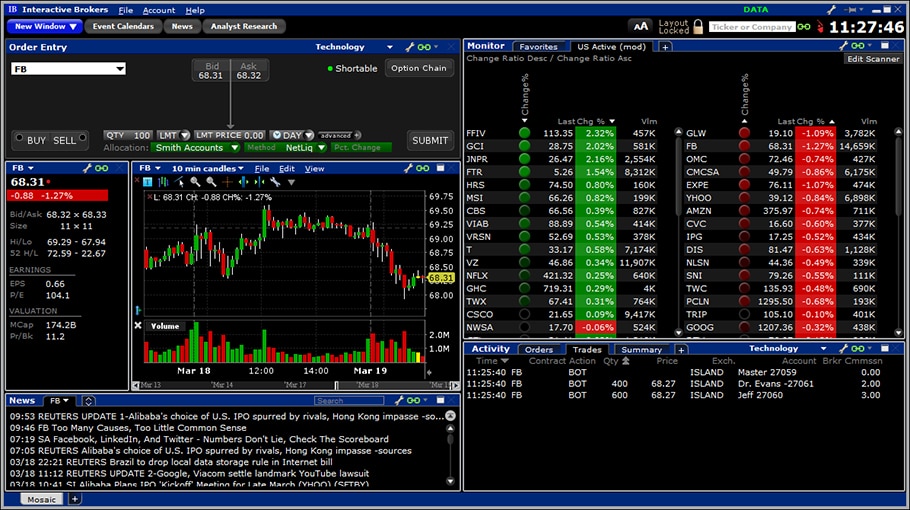

Online day trading exploded in popularity with commercial use of the internet. Traders no longer need a seat at the stock exchange or a direct line to brokers. Instead, individuals receive security quotes from the comfort of their living room. They are able to trade with others worldwide through various exchanges. Various software packages exist in the industry. We will discuss the best day trading platform options, and what makes them stand out. Quotes are no longer available to only broker-dealers or market makers. Through direct market access (DMA), individual traders interact with the order book of an exchange. This

Traders focus on cheap stocks because of their upside potential. Stocks cannot be priced below $0. This gives them defined risk limits with uncapped upside. However, trading these name is not as simple. These stocks are cheap for a reason. Identifying the best cheap stocks dramatically increases the odds of success. Important characteristics of the best cheap stocks are liquidity, short interest, and analyst coverage. Some investors build positions over time in these names. Conversely, quicker traders buy into a short squeeze intending to sell after the shorts have capitulated. Whatever the strategy, it is vital to understand potential upside

Short-term traders need stocks to move in order to profit. There needs to be volatility, otherwise traders would not thrive. The most volatile stocks in the market make the best candidate for trading. However, volatility means extra risk to unprepared traders. It is common for a sector to contain the most volatile stocks, over a given period. For instance, if uncertainty exists in oil markets due to geopolitical concern, oil stocks could be the most volatile for a period. That in mind, let’s take a look at some of the most historically volatile stocks. Additionally, we will look at how

Trading the financial markets can be a lucrative and liberating profession. Individuals are drawn in because of its low barriers to entry, intellectual exercise, and potential for financial freedom. Do you know how to become a day trader? Many people have a distorted view about day trading and what a day trader does. Commercials and advertisements fill the internet with promises of expensive cars and glamorous lifestyle. Of course, it’s possible if you master the skill of trading… but the reality is most who try will fail. How To Become A Day Trader – Getting The Idea The stock market

Of all the stocks in the market, which are the top 10 best to buy now? Whether one is new to the financial markets or a seasoned veteran, it is our hope that this discussion will provide valuable insights into stock picking. It is important to note that we will be discussing real companies with real products. Also, we will talk about different market sectors. A sector is simply a classification of a company, such as technology. Take all these sectors together, and we have what is referred to as the stock market. Different sectors act differently given certain investor

Day trading is a career for some, and a hobby for others, and even a dream for more. This article will explain in detail day trading rules, how to day trade, and even some day trading strategies. Day trading has been much more popular since the advent of online brokerage services and direct market access platforms (DMA). DMA is another term for electronic trading capabilities that bring participants from across the globe together. This will be necessary for a day trader, as it shows them the book listed on the exchanges on which the financial instrument can be traded. We

What are the best stocks to invest in right now? Below, we discuss what constitutes an investment that grows over time. It is critical that an investor sticks to the prepared plan. Markets will fluctuate- it is in their nature. Those who are prepared and understand what is happening will be rewarded. Conversely, those who use emotion to make decision will be left penniless, a distant memory of the market. The stock market is an important entity for those looking to grow capital and save for things such as retirement or education planning. Many individuals perceive the market to be

Almost 4,000 stocks exist in the primary investable universe. With such a large spectrum of choices, how can individual investors be expected to make informed decisions and consistently profit? Better yet, what are the top stocks to invest in? Successful investing consists of finding good risk/reward ideas and having the vision to allow those ideas to mature into profits. We will discuss what makes a good stock investment, ways to identify real companies with real goods and services, and how one can expect to profit from these investments. Some of the companies listed may sound familiar, others foreign. The important

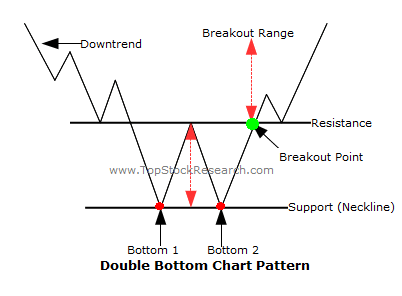

Momentum trading strategies are employed by traders who believe in the saying “the trend is your friend.” This contrasts mean reversion traders who believe that prices revert to a historical mean. Momentum traders rely on a strong trend in either direction and above average volume. Some stocks are referred to as “momentum names” because they are historically large movers. Once a stock garners this designation; it becomes a self-fulfilling prophecy. The stock will attract more momentum traders hoping to profit from a sustained move in either direction. Many times, these names are companies with a new product, or an innovative