When it comes to trading good stocks to buy there are several schools of thought. Some traders prefer to day trade exclusively. They find comfort in closing out the day in cash, knowing that an overnight event can’t hurt them. On the other hand, some traders like to hold on to positions for days, weeks, or even months, in hopes of capturing larger moves. Their thinking is that day trading involves too much randomness and that the markets are largely dominated by algorithmic trading. What’s the best way to trade? Well, in order to day trade good stocks to

Do you want to make lots of money trading penny stocks in the shortest amount of time possible? Of course you do…I mean who wouldn’t? Everyone wants to take a little bit of money and make it into something substantial. Now, there is nothing wrong with having lofty goals. In fact, setting goals for ourselves is a great way to stay focused and motivated. However, you’ve got to be realistic…and you’ve got to be smart about building up your trading account. The Mind Set When Trading Penny Stocks Think of the money you deposit in your account as it’s

Most successful traders have a business approach when it comes to describing their trading of hot penny stocks. The objective is to try to extract the most money out of the market, while keeping risk exposure relatively low. It’s not about gambling or taking shots, hoping to rake in that big pay day. Now, if you’re unsure of what having this business approach means, here are some things you should consider: Infrastructure Expenses This will include any news service, chat room, research, execution platform, or any other trading tool that you’ll be using to generate and execute trade ideas

How much money do you need to get started to trade good penny stocks? That is a question you’ll hear asked a lot from those interested in giving trading a go. The reality is that there is no right answer here. However, you should probably get started as soon as possible. You see, in order to become a great trader you need skills. The way to develop skills is from learning how do the right things at the right time. Of course, this is developed from experience. And in order to gain experience, you’ve got to be in the game.

When it comes to trading good penny stocks, fewer things can be more frustrating than getting the direction right on a trade, but failing to profit because you were sized to big and got shaken out of the position. The way you position a trade can be the difference between making extraordinary profits or losing your shirt. Let’s face it, not every trade is going to instantly work in your favor. That means you’ll need to absorb a drawdown before potentially gaining on the trade. Here are some ways you can go about position sizing. The first, is choosing an

The more prepared you are as a trader, the better the chance you’ll be able to make swift decisions when the pressure is on trading good stocks to buy. One excellent way to be prepared is to have watch lists on hand. For example, let’s say there are negative comments on a specific pharmaceutical company, the stock price might react negatively, but it might also affect similar companies in that same niche. Imagine you had list of good stocks to buy in that specific sector and were ready to trade off the news vs. scrambling and thinking what other company

When traders day trading stocks introduce themselves to each other, they’ll often ask each other, “What type of trading do you focus on?” For example, some traders focus purely on fundamental analysis, others might focus strictly on news driven events, someone else might focus on specific technical setups. I could go on and on, hopefully you get the picture. There are several methods and approaches traders use to try to beat the market. For the most part, nearly every trader ends up failing. It could stem from a lack of capital, time, knowledge, discipline, tools, or even a poor strategy.

In a nutshell, online stock trading is like any other business. Take a sum of capital and put it to risk, hoping that it will yield a positive return. The trick is to put that capital into something you believe in…this gives you a strong probability of getting that positive return. So many traders get consumed about the money early on. Of course, the money can be great…but you can’t put the horse before the cart. There is a process involved in developing into a successful trader and becoming really efficient at online stock trading. That includes learning how to execute

What is technical analysis? It’s the process of analysing price movements (past and present) of an asset in hopes that it can give us some indication on where it might trade in the future. Generally, this done by observing a chart of the security when looking to buy stocks online. Why should you care? Since most discretionary stock trading consists of having an opinion on the future direction of a security, it’s important to have tools that help us generate ideas that provide an edge. Technical analysts makes a couple of assumptions Price

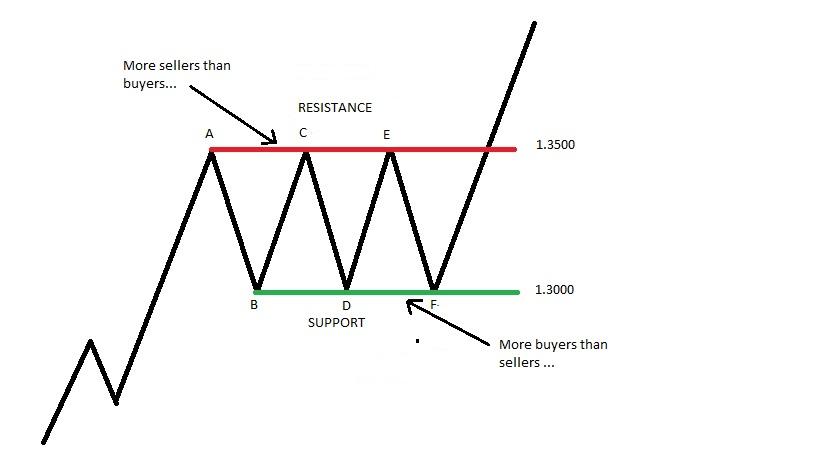

Identifying support and resistance is the backbone to technical analysis, and it’s essential to anyone interested in using technical analysis in their trading of the best penny stocks. Fortunately, with proper guidelines and practice, it is a skill just about anyone can gain. With that said, let’s define what we mean by support and resistance. Definition: Support and Resistance Support is defined as a price level where an asset stops declining due to the presence of more buyers than sellers. On the other hand, resistance is a price level where the asset can no longer rise because there are more