Finding penny stocks with high volume is always on the list of priorities for day traders; when they get it right and execute properly, the gains can be amazing. But many day traders struggle with this process. Often they find a penny stock that looks on the surface to be trading with high volume, but which in actual fact, is not really a high volume penny stock. One of the big problems here is a lack of a cogent definition of what marks penny stocks with high volume. We aim to show you how to define and find the very best penny stocks with high volume.

Penny Stocks With High Volume – Getting The Definition Right

How much is high volume? That’s a pretty straightforward question but believe it or not, the answer is not very straightforward. One could take a penny stock (defined as a security trading below $5), and then look at the number of shares that are traded on average, over say a 30-day period. A stock with say average volume of 1M shares may be considered to be high volume, but a closer look may reveal something different. If the penny stock is in a sector that usually sees average stocks trading more than say 10M shares, then a penny stocks with high volume of 1M shares is probably not a good pick.

A more accurate way of defining high volume, then, is to use a minimum average daily benchmark. In most cases a minimum average daily volume of more than 2M shares is a pretty good strategy of picking penny stocks with high volume. So how do we actually fish for them? For that we turn to the trusted penny stocks screener.

Breaking: Get Alerts On Stocks That Could Double And Triple For Free!

Penny Stocks With High Volume – Using A Screener

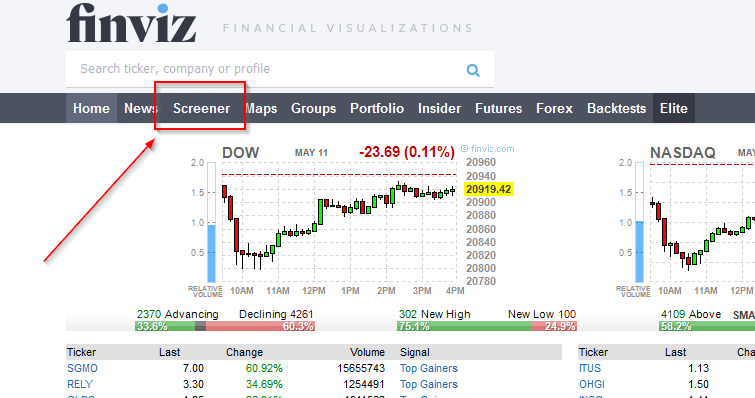

There are plenty stock screeners available online and most of them are free. One of our favorites is the stock screener found at http://finviz.com/screener.ashx.

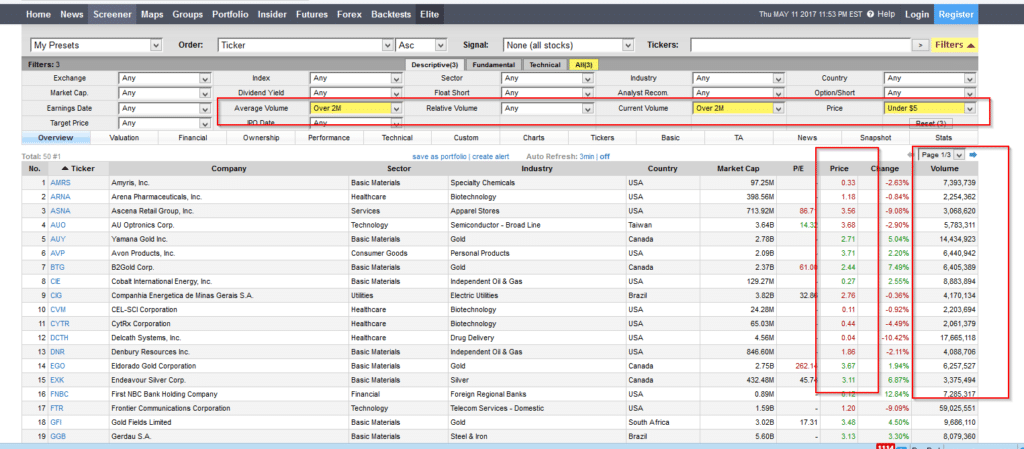

The first thing you want to do is bring up the screener:

Source: Finviz.com

From there you simply make your inputs into the screener. For our example we’ve gone for stocks that are priced below $5 with both average and current volume being > 2M shares. As you can see the screener is pretty effective. The price column shows a good mix of penny stocks with the accompanying volume figures sitting neatly in the column next to it. From there it is simply a matter of working out your finer criteria for selecting your penny stocks with high volume. You may or may not have an industry sector in mind – this and other filtering criteria could help make up your final selection. In any event, it is clear that fishing for penny stocks with high volume is not particularly difficult if you know what you are looking for.

But what if you struggle beyond the basics of selecting penny stocks with high volume? What if you don’t have an effective strategy for fine-tuning your criteria? In that case we believe the most effective strategy is to have someone do your penny stock selection for you. Many newsletters will provide this service and some are 100% free. By allowing an experienced day traders to locate and assess penny stocks with high volume, you are in a better position to concentrate on the more important aspect of day trading success: the execution of trades.

We hope this quick tutorial was helpful. You can leverage the help of a free newsletter service for penny stocks with high volume in UltimateStockAlerts.