Penny Stocks – Everything You Need To Know

As an investor, it’s important to not limit yourself to one investment vehicle. After all, there will be times when interest rates are high, and inflation assets like gold and commodities make sense. When interest rates are low, stocks and real estate tend to perform better. Regardless, if the last financial crisis taught us anything, it’s that diversification and being nimble is key.

That also means that you need to keep an open mind. For whatever reason, one sector of the stock market that gets a bad reputation is penny stocks, but as you’ll see it’s very undeserved.

Now, before we get into it, let’s familiarize ourselves with what penny stocks are and what they’re not.

According to the SEC, a penny stock is a publicly-traded company that trades at $5 or lower. Penny stocks are traded on the major exchanges like the Nasdaq and New York Stock Exchange. In order to be listed on one of these exchanges, a company needs to meet certain requirements pertaining to shareholders equity, pre-tax income, market capitalization, distribution, price, and market value of public float. In other words, a company must disclose a bevy of information before they can be accepted.

Why does everyone hate penny stocks?

Well, not all penny stocks are traded on the major exchanges, many of them are traded off of them. These companies are listed as “pink sheets”, and they’re not governed by heavy rules, regulations, and requirements. In fact, there are no minimum standards for pink sheet stocks. That means they don’t have to disclose financial information.

Without financial information being disclosed, it becomes extremely difficult for market makers to price the value of a stock. Not only that, but analysts don’t have enough information to properly research the stock, and therefore, they are less likely to cover the stock.

Obviously, you can imagine the type of problems that this brings. If the top analysts and market making firms are out of the picture, that leaves the stocks vulnerable to rumors, attacks, third party research, and unverified reports.

Obviously, you can imagine the type of problems that this brings. If the top analysts and market making firms are out of the picture, that leaves the stocks vulnerable to rumors, attacks, third party research, and unverified reports.

With that said, the more transparent a company is, the easier it will be to make trading decisions on them. If a company decides not to disclose critical financial information, then that should be viewed as a red flag and something you might want to stay away from.

Yes, trading penny stocks can be like the wild wild west, but only if you want it to be. If you stick to transparent companies, preferably ones that trade on the major exchanges, you’ll be less likely to come across some of the unethical schemes that were once associated with penny stocks.

How To Avoid Bad Penny Stocks

- Stick to trading transparent companies. Trading stocks listed on the NYSE or Nasdaq are examples of transparent stocks.

- Do your own due diligence. We live in a world of fake media and sponsored content. With that said, you need to take responsibility if you’re going to trade for yourself. That means not trusting everything you read or hear.

- If something is too good to be true… it probably is. If stock research sounds more like an infomercial than research be very skeptical it’s claims.

These are really simple to follow rules that will help you avoid many of the common traps associated with trading hot penny stocks.

Moving on.

Benefits Of Penny Stocks

Since most penny stocks traded on the major exchanges are microcaps, hypothetically they have more upside potential than say blue chip stocks do. For example, certain type of positive news can send a penny stock’s price soaring.

Think about it like this, an overweight person joins the gym and begins an exercise and diet program for the first time in their life. In the beginning, they will show tremendous improvement because they have gone from a position of inactivity to a more active lifestyle. However, an elite athlete will have a harder time improving since they are already in great shape. This loose analogy can sort of be applied when comparing the growth potential of good penny stocks to blue chip stocks.

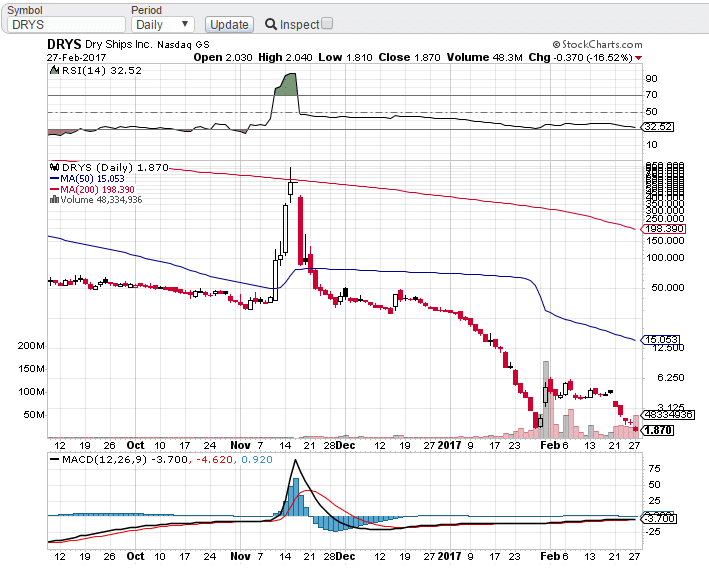

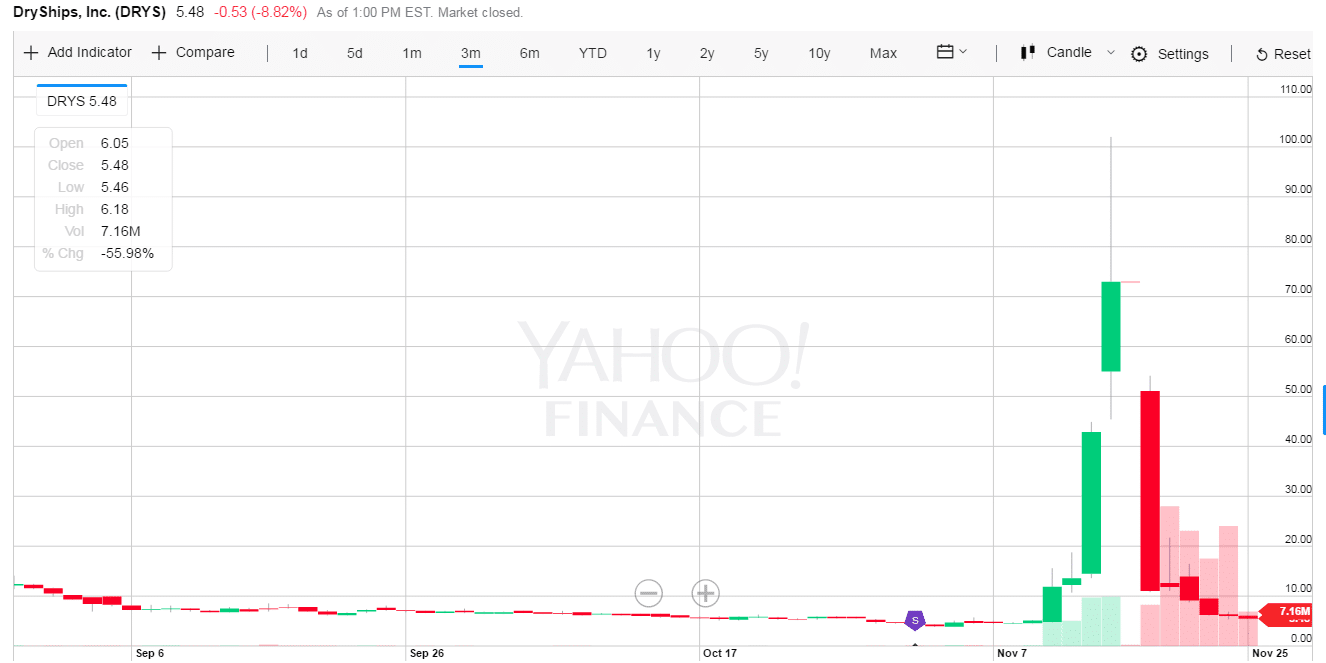

On November 9, 2016, DryShips (DRYS) was trading under $5 per share… In less than a week, it was trading as high as $100 per share. These types of moves are nearly impossible to see in blue chip stocks in such a short period of time.

You see, with best penny stocks, there are certain dynamics in play. For example, a stock might move because of positive news; maybe there is a high short interest; or a small number of shares available. Since many of these companies are not heavily researched by the street, they are capable of having monster moves.

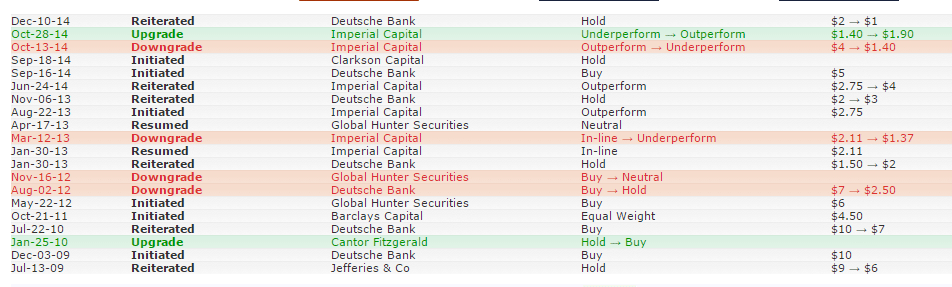

DryShips went from $5 to $100 in less than a week. You would think that would have caught the attention of Wall Street. However, a quick look at the upgrades and downgrades, you’ll see that it hasn’t been covered in years!

Why Many Penny Stocks Are Undervalued

Since some of the more sophisticated investors are not bothering with penny stocks, that means the competition is not as fierce. Keep in mind, you’ll have to roll up your sleeves and do your own due diligence. The type of returns that can be had in penny stocks should be enough motivation for you.

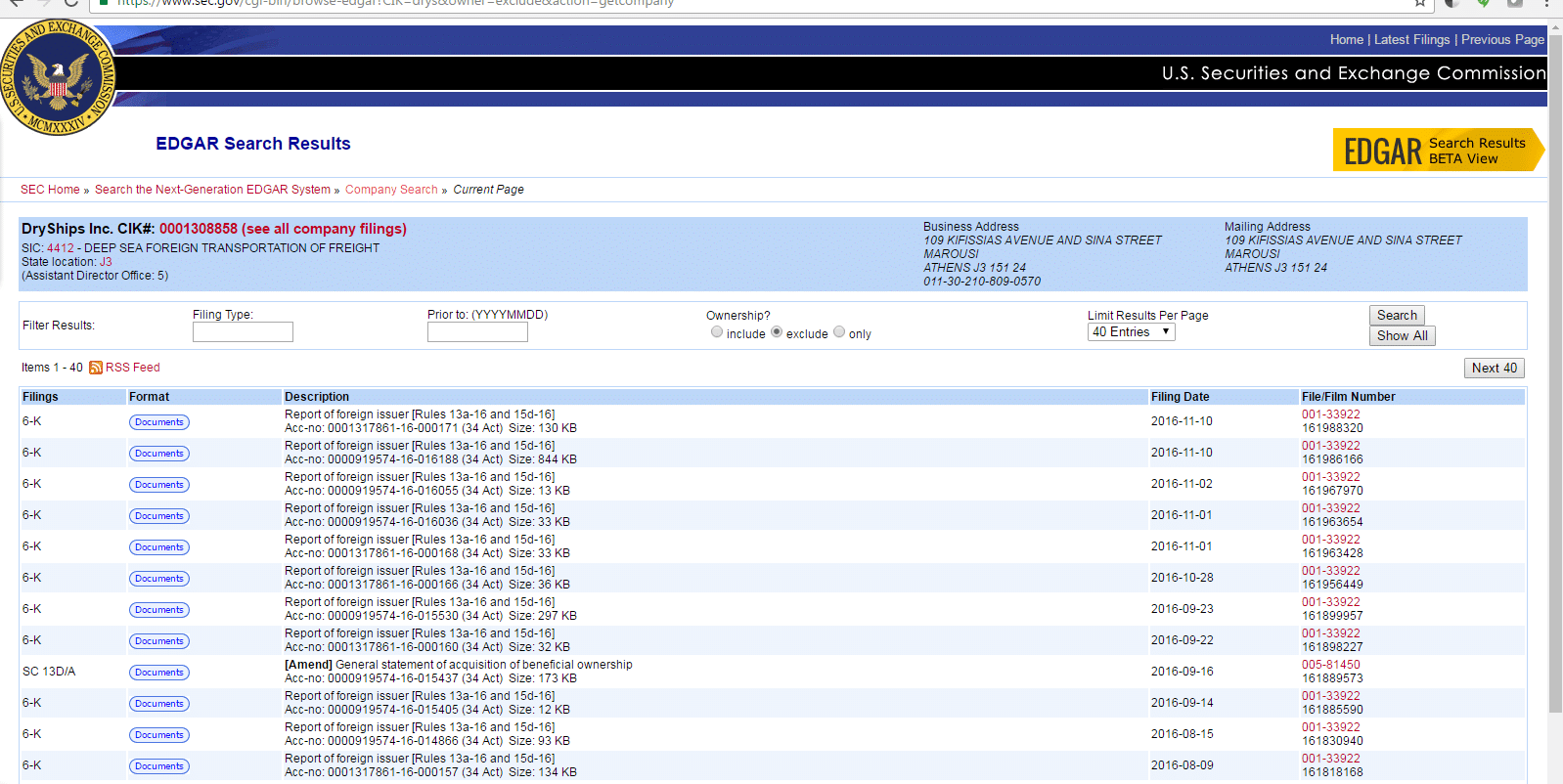

Now, one of the best sites to visit for research is SEC’s website. More specifically, EDGAR, which allows you to research Company Filings.

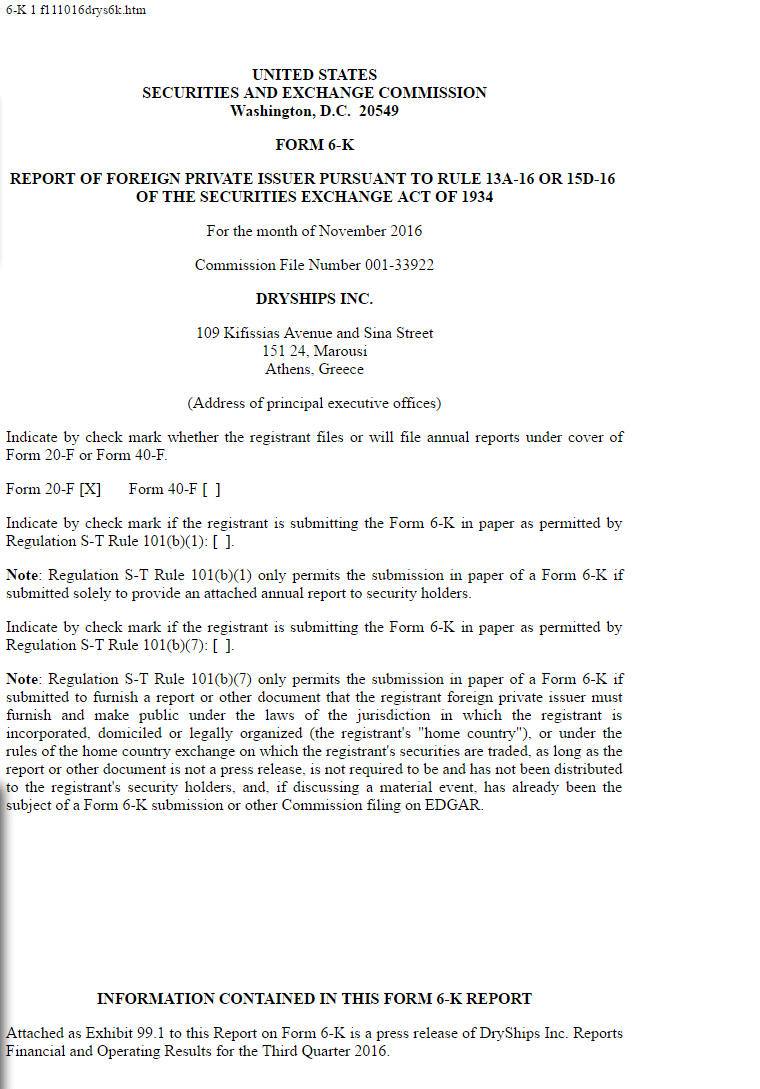

For example, let’s say we wanted to learn more about DryShips since there isn’t much institutional research on the company. By typing in the company’s symbol in the fast search space, you’ll be able to catch up their latest filings.

We can proceed further by clicking on the links and reading the disclosed forms.

Now, this might seem like a laborious process. However, there is no free lunch trading. Think about it this way, if you do your own homework, then you compare it with someone else’s research, you’ll be able to verify the research. Essentially, by being informed you can weed out the good research from the bad. Eventually finding some trusted sources that can add value to your trading.

Advantage Of Investing In Penny Stocks

Low barrier of entry

You don’t need a ton of capital to get started. Compare that to say something like Apple stock, which at the time of this writing was trading around $107 per share. In order to buy 100 shares, you’ll need more than $10,000 in risk capital. Now with that same amount of capital, you can buy 2,000 shares of stock that trades $5 per share. Since these small caps are more vulnerable to larger price swings, but there’s a greater potential for outsized returns, like the one witnessed in DryShips.

Are All Penny Stocks The Same?

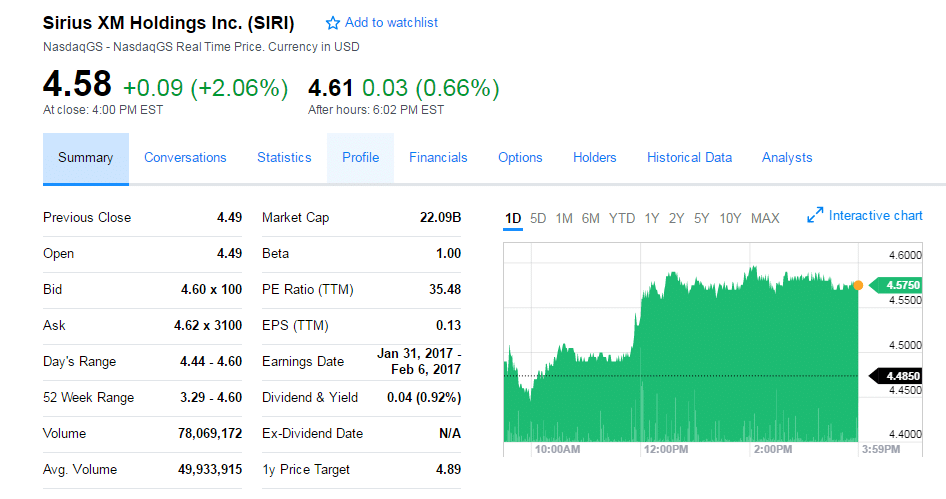

This one is a fairly easy question to answer, NO. You see, just because a company’s stock is trading under $5 per share, it doesn’t necessarily mean it’s not established or is a small cap company. For example, Sirius XM Holdings (SIRI), was trading at $4.58 a share at the time of this publication, however; the company has a market cap of over $22 billion dollars. Not exactly a mom and pop, right?

So it’s important not to think about a list of penny stocks based on their share price alone. Other factors to consider include the number of outstanding shares, the number of shares that are floating, the percentage of the float that is short, along with the market cap and other important financials concerning the company.

Where Can I Find Information About Penny Stocks

Well, we touched on one of the most important websites already, the SEC website. However, there are a ton of other free resources available. For example, here are a few worth mentioning:

If we wanted to know more about Sirius XM Holdings, we would type in the ticker symbol and receive an abundance of information pertaining to the company. You can find out who the top shareholders are, what the balance sheet looks like, a list of the company’s competitors, news, statistics, stock charts, and a whole lot more useful information on Yahoo! Finance.

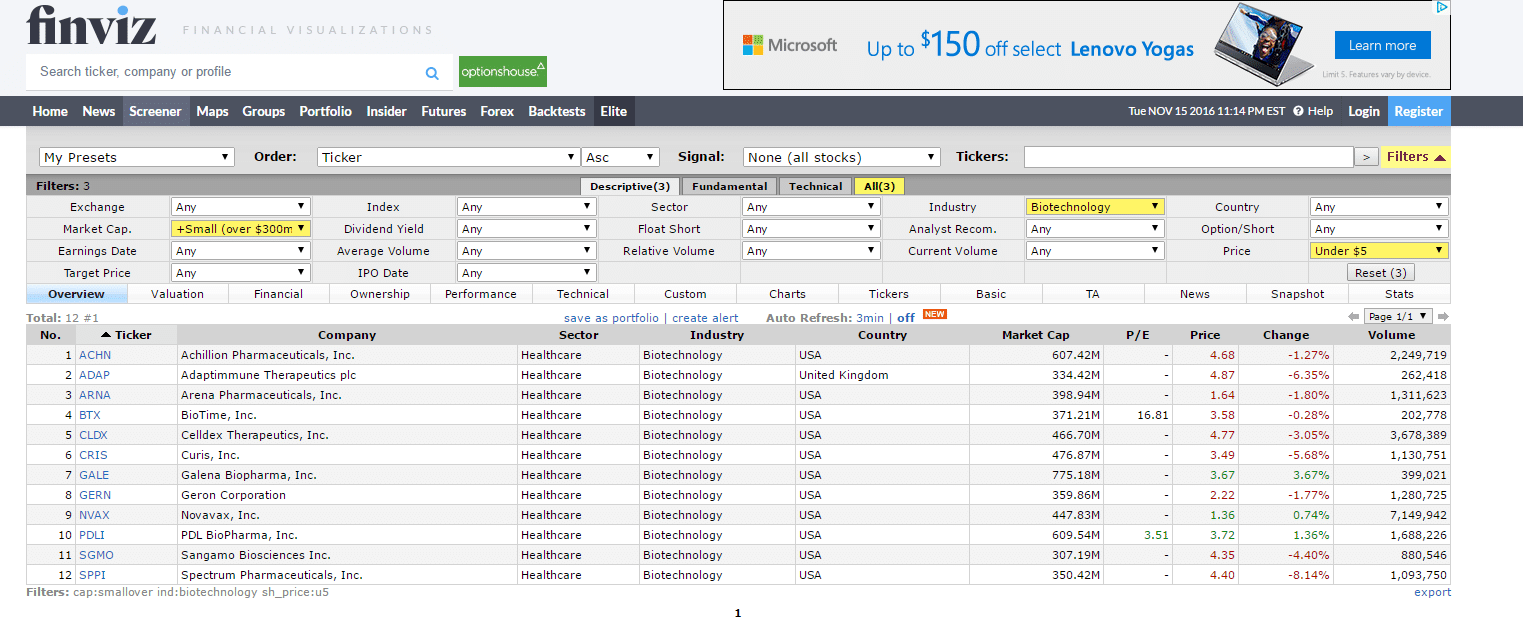

Finviz is short for financial visualizations. In terms of content, you’ll find some similarities with that of Yahoo! Finance. However, the presentation on finviz is a lot cleaner. What really sets it apart is it’s stock screener.

That’s right, you can create lists based on which exchange a company is being traded on, it’s market cap, average volume, sector, float short, industry, price, and a whole lot more. In fact, you can filter fundamental and technical information as well.

In the above example, we created a filter based on market cap, industry, and stock price. Based on that criteria we found 12 companies that were small cap, trading under $5, and were in the biotechnology space. This can be an extremely powerful tool that can be used for idea generation and creating watch lists.

For the most part, the three websites mentioned above are great places to start if you’d like to know more about which individual penny stocks to trade or generally good stocks to buy.

Blue Chips Versus Penny Stocks

Since many penny stocks have low market caps and are not heavily covered/researched by analysts, they tend to be more volatile. For example, a 20 cent move in Apple shares is not newsworthy. However, if a penny stock moves from $1 to $1.20, that’s a 20% move. One could argue based on volatility alone, penny stocks offer more opportunity.

With that said, one could get away with day trading penny stocks because of the opportunities they provide. We mentioned earlier that the barrier of entry is low, but before you open up a brokerage account and start slinging away there is something you need to know.

There are rules in place to discourage small accounts from active trading. For example, if you execute 4 or more day trades in 5 business days in a margin account, provided the number of day trades are more than 6 percent of your total trading activity for the same 5 day period. You’ll be labeled a pattern day trader, which means that you need to have a trading account of at least $25k. For whatever reason, if you exceed this threshold amount of trades and your account dips below this level, your broker will temporarily freeze your account from trading.

One possible way to get around this is by opening up more than one brokerage account. For example, if you’ve only got $10k of risk capital and would like to stretch out the number of day trades, having two separate brokerage accounts can do that for you. Whatever you decide to do, keep the pattern day trader rule in mind.

It can easily be argued that top penny stocks offer the most opportunity. For the last several years volatility has been relatively low because central banks taking a more active role in the stock market. Trading penny stocks offers an opportunity to trade both sides. For example, if you believe a stock has had a silly move towards to the upside, you can always take the other side and short it. Since there are less buy programs and high frequency traders in penny stocks, you’re more likely to have better interactions between sellers and buyers.

In fact, when selecting a broker, you should inquire what their policies are on shorting penny stocks. Some brokers are better at locating shares to short than others. Remember, in order to short a stock you need to find someone to borrow them from. In that respect, having more than one brokerage account might make a lot of sense.

Why Do People Hate Penny Stocks?

Well, on October 3, 2016, something called the tick size pilot program was introduced. Basically, it’s an attempt by the regulators to add greater liquidity to small cap stocks. The program consists of a control group and 3 test groups, with 400 stocks per test group.

The way it works is like this:

The control group trades in its normal fashion. However, the first test group will be quoted in nickel increments. So instead of stocks being quoted in penny increments, like $2.00 bid — $2.01 offer, they’re now $2.00 bid — $2.05 offer.

The second group is also quoted like the first group. It does have some minor exemptions. Lastly, the third group works like the second group, but they have some rules for large block trade orders. In addition, they are subject to the trade-at-rule, which means that you must trade what is displayed first before going to a dark pool to execute.

The program’s goal is to get more financial institutions interested in small cap stocks. It’s too early to tell what the outcome of the tick size pilot program will be.

Now, it’s also worth mentioning that some mutual funds will not touch stocks trading $5 or less. Of course, each mutual fund has their own set of rules and criteria, but it’s not uncommon for them to not add penny stocks to their portfolio. With that said, that is one of the reasons why some best penny stocks lack liquidity and have price inefficiencies. Again, we’ll have to see if the tick size pilot program can improve on this anomaly.

Long-term Versus Short-term Penny Stock Investing

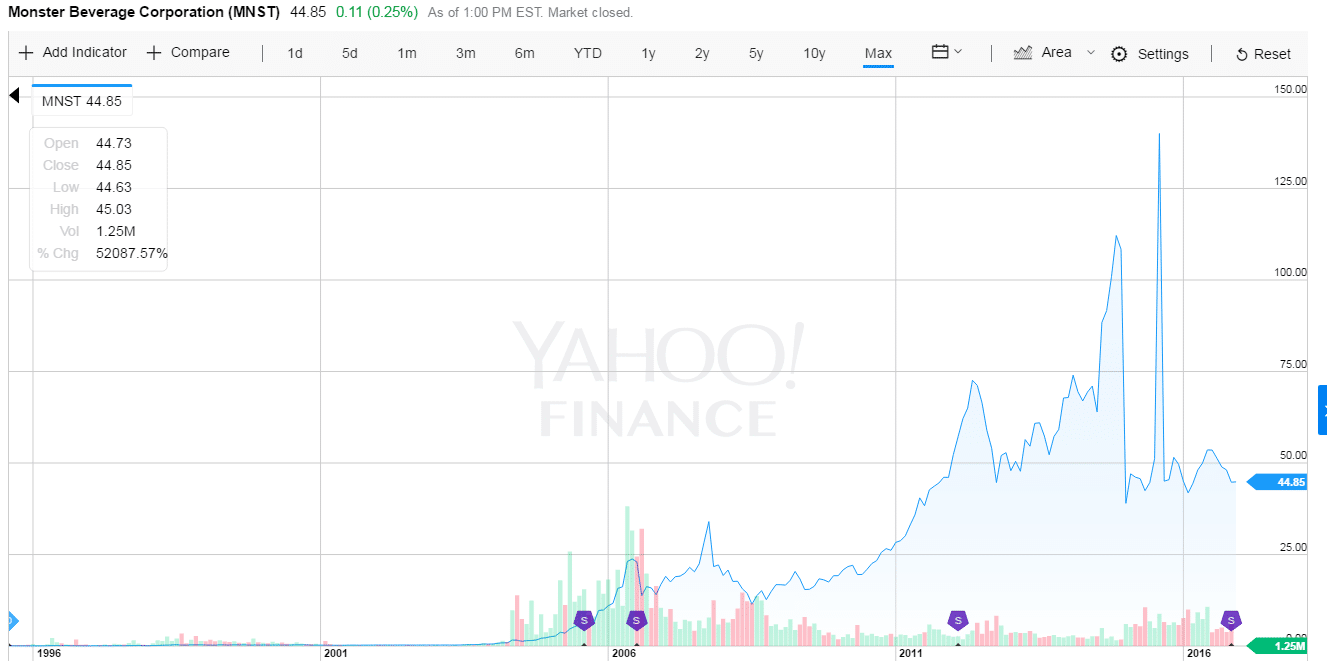

Over 20 years ago you could have picked up shares of Monster Beverage Corporation (MNST) for under ten cents a share. Since that period the stock price has risen more than a whopping 50,000% … that’s not a typo folks.

I hope that debunks the notion that penny stocks are not investable vehicles. In fact, at the time of this writing, the returns on Monster Beverage have trumped that of Apple and Google.

Just like any other investment, if you do your due diligence you can find diamonds in the rough. The returns seen in Monster Beverage are exceptions not the rules, but that doesn’t mean real investment opportunities don’t exist in penny stocks. To get constant penny stocks alerts, join Ultimate Stocks Alerts today.

On the other hand, you need to be careful because some penny stocks are vulnerable to crazy moves like the one mentioned in DryShips.

The stock traded above $100 and shortly fell back to trading below $6 per share. How could something like this happen? Well, a large percentage of traders borrowed shares to short the stock; in fact, there was an abnormally high short interest in the stock. In addition, there was a very small float, only around 1 million shares available. In essence, it was a classic short squeeze.

There was no manipulation in terms of a pump and dump scheme, or any news to that matter. It was simply a short squeeze that extended itself beyond many traders expectations. These type of events are more common in penny stocks since they have a small microcap and don’t have a lot of shares outstanding. In this case, we wouldn’t say the stock was manipulated, but it was more or less hijacked based on some market dynamics.

This is a pretty extreme case, but these things do happen and something you should be prepared for if you’re interested in being a long-term investor in penny stocks. In regards to trading penny stocks, there is enough volatility to day or swing trade them.

Summary

- Not all penny stocks are the same. Some have to adhere to high requirements, in order to be listed on on the major exchanges, while others have to disclose very little to be traded over the counter.

- Penny stocks offer opportunity because many of them are not covered by big banks and research firms. If you do your own due diligence, you’ll have an upper hand over most of the competition.

- On the downside, some penny stocks are not overly liquid and make for poor trading vehicles.

- Penny stocks make for good investing and trading. However, given certain market anomalies, penny stocks are vulnerable to price shocks, which make investing challenging.

- The barrier of entry is low, making penny stock trading more accessible to most individuals.