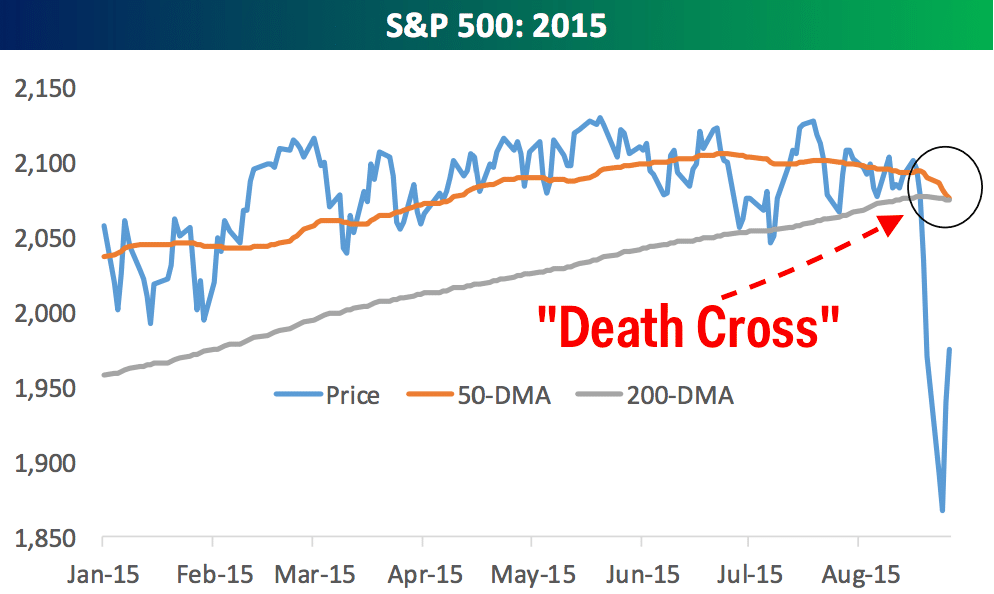

In order to understand the stock market death cross, there’s an important concept called a crossover which first has to be understood. Consider the crossover an essential foundation for reading a death cross – without this important charting event, no reading can take place. So what is a crossover? A crossover occurs when a security intersects one of its key technical indicators. The key indicators used to predict future movement of a stock vary, but the daily moving average continues to hold sway among traders and investors. An example of such a crossover would be when a security – i.e.

Tag Archives: exit strategy

When it comes to trading good penny stocks, fewer things can be more frustrating than getting the direction right on a trade, but failing to profit because you were sized to big and got shaken out of the position. The way you position a trade can be the difference between making extraordinary profits or losing your shirt. Let’s face it, not every trade is going to instantly work in your favor. That means you’ll need to absorb a drawdown before potentially gaining on the trade. Here are some ways you can go about position sizing. The first, is choosing an